Trump hits Brazil, India commerce after clinching North American trade deal

(Reuters) - Fresh from clinching an updated North American commerce pact, U.S. President Donald Trump on Monday criticized Indian and Brazilian trade tactics, describing the latter as being “maybe the toughest in the world” in terms of protectionism.

Addressing reporters at a White House event to celebrate the agreement of an updated trilateral trade deal between the United States, Mexico and Canada, Trump added India and Brazil to a growing list of countries that, he argues, treat the world’s top economy unfairly in terms of commerce.

“India charges us tremendous tariffs. When we send Harley Davidson motorcycles, other things to India, they charge very, very high tariffs,” Trump said, adding that he had brought up the issue with Indian Prime Minster Narendra Modi, who he said was “going to reduce them very substantially.”

Modi’s office could not immediately be reached for a request for comment. India’s government has become more protectionist in recent months, raising import tariffs on a growing number of goods as it promotes its ‘Make in India’ programme.

After criticizing India, Trump turned to Brazil, the second-largest economy in the Americas behind the United States.

“Brazil’s another one. That’s a beauty. They charge us whatever they want,” he said. “If you ask some of the companies, they say Brazil is among the toughest in the world - maybe the toughest in the world.”

Brazil is one of the world’s most closed major economies, and in recent months has tussled with the Trump administration over trade in sectors such as ethanol and steel.

After Trump’s comments, Brazil’s Foreign Trade Minister, Abrão Neto, defended the relationship, saying it was “very positive.” He added that over the last 10 years, the United States has enjoyed a trade surplus with Brazil of $90 billion in goods, and of $250 billion in goods and services.

Neto pointed out that the United States was Brazil’s second-largest trading partner, behind China, and that the two countries had a “complementary and strategic” commercial relationship that could, nonetheless, be improved.

Trump’s “America First” trade policies, particularly his escalating trade war with China, are aimed at boosting U.S. manufacturing, but they have spooked investors who worry that supply lines could be fractured and global growth derailed.

There are now U.S. tariffs active on $250 billion worth of Chinese goods, with threats on additional goods worth $267 billion.

Reporting by Steve Holland, Marcela Ayres and Mateus Maia; writing by Gabriel Stargardter; Editing by James Dalgleish

Trump hails Canada, Mexico trade pact as win for U.S. workers

WASHINGTON (Reuters) - President Donald Trump on Monday touted a new trade deal with Canada and Mexico as a win for U.S. workers while investors breathed a sigh of relief that the key pillars of NAFTA had survived his hardball strategy to reshape global commerce.

Washington and Ottawa reached an agreement on Sunday after weeks of tense bilateral talks to update the 1994 North American Free Trade Agreement. The United States had forged a separate trade deal with Mexico, the third member of NAFTA, in August.

The new agreement, called the United States-Mexico-Canada Agreement (USMCA), is aimed at bringing more jobs into the United States, with Canada and Mexico accepting more restrictive commerce with the United States, their main export customer.

“These measures will support many - hundreds of thousands - American jobs,” Trump said at the White House, describing the trade deal as “the most important” the United States had ever made.

“It means far more American jobs, and these are high-quality jobs,” he said. Trump had repeatedly called NAFTA a terrible deal for the United States.

Any U.S. job gains are likely years away, but the deal provides Trump with a victory that he can tout at campaign rallies over the next month on behalf of fellow Republicans running in the Nov. 6 congressional elections.

But auto industry officials privately said job gains would be more limited, partly because tighter autos content rules would raise their costs even as the deal eases worries that they would have to tear up supply chains and move existing assembly plants.

Praise from the lobbying group representing Ford Motor Co (F.N), General Motors (GM.N) and Fiat Chrysler (FCHA.MI) was measured.

Matt Blunt, president of the American Automotive Policy Council, called the deal “a workable agreement” achieved through a close relationship between the automakers and U.S. negotiators.

Speaking in Ottawa, Canadian Prime Minister Justin Trudeau said the deal removed uncertainty, but he conceded that Canada had made some difficult compromises. Canada’s dairy industry criticized him for giving more market access to U.S. imports.

“We had to make compromises, and some were more difficult than others,” Trudeau said at a news conference. “We never believed that it would be easy, and it wasn’t, but today is a good day for Canada.”

Trudeau did win a face-saving preservation of a key trade dispute settlement mechanism to fight U.S. anti-dumping tariffs.

Initial U.S. reaction was effusive, with auto workers, dairy farmers and wheat producers saying the deal would likely create job opportunities and open up agricultural markets.

A NAFTA collapse could have caused U.S. farmers, a key Trump constituency, to lose access to major agricultural markets in Canada and Mexico at the same time that China has halted purchases of U.S. soybeans and other commodities due to a tariff war. NAFTA underpins about $1.2 trillion in annual trade between its three member countries.

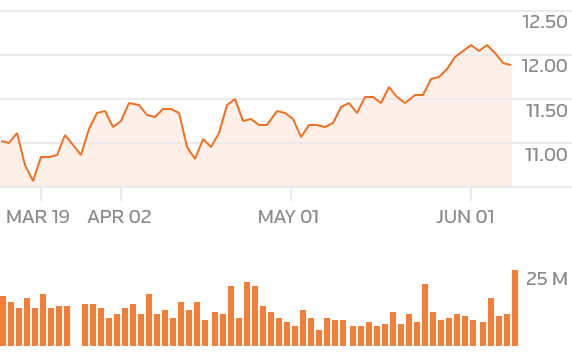

U.S., Canadian and Mexican stocks jumped early on Monday before paring gains later.

The Canadian dollar CAD=D4 strengthened to a four-month high against the U.S. dollar, while the Mexican peso MXN=D3 rose to near a two-month high against the greenback.

EYES ON CHINA

The deal ends a major source of trade irritation as the Trump administration pivots to a much bigger fight with China, where U.S. tariffs now are active on $250 billion worth of Chinese goods and threatened on $267 billion more.

The head of the International Monetary Fund, Christine Lagarde, issued a new warning on Monday that rising tariffs were dimming the global growth outlook.

U.S. Trade Representative Robert Lighthizer has been working to recruit Japan and the European Union to help pressure China to change its trade, subsidy and intellectual property practices. With a deal that preserves U.S. market access, Canada and Mexico now are more likely to join that effort.

While Trump’s goals for revising NAFTA were to shrink U.S. trade deficits, claw back lost manufacturing jobs and add new IP protections and digital trade chapters, the new pact leaves North American trade flows largely unaltered.

“The most significant thing about this new deal is that they changed the name,” said David Kelly, chief global strategist for JPMorgan Asset Management. “It really is tweaks to NAFTA.”

The deal effectively maintains the auto industry’s current footprint in North America, and spares Canada and Mexico from the prospect of U.S. national security tariffs on their vehicles.

Slideshow (3 Images)

Over time it will force auto companies to spend billions of dollars to produce more of their future products in the United States or Canada to meet new requirements that 40 percent to 45 percent of a vehicle’s value content come from high-wage areas.

Auto makers, particularly from Europe and Asia, may be pushed to move more of their supply chain into the region.

Mexican Economy Minister Ildefonso Guajardo, who led his country’s trade negotiations, said the agreement was an attempt to make the region more competitive versus Asia and Europe.

“Everyone is trying to entrench themselves in their region to compete with other regions,” Guajardo told Mexican radio.

Unifor, Canada’s biggest private sector union, said the deal was likely positive for auto workers, as it requires a much higher percentage of parts to be made in North America, with a significant proportion produced in areas paying at least $16 per hour.

STEEL TARIFFS STAY

The deal does not include any changes to separate U.S. tariffs on steel and aluminum levied earlier this year on Canada, Mexico, China, the European Union and others.

Trump said the those tariffs - 25 percent on steel and 10 percent on aluminum - would remain in place for Canada and Mexico until they “can do something different like quotas, perhaps.”

“We are not going to allow our steel industry to disappear,” Trump said, adding that Sunday’s deal would not have happened without the tariffs.

Both Trudeau and Mexican Foreign Minister Luis Videgaray said the tariffs needed to be removed before the new trade deal is signed on Nov. 30.

Passage of the deal by the U.S. Congress is not expected until the spring of 2019, after November elections could shift control of the House of Representatives to Democrats from Republicans.

Some Democrats may be reluctant to give Trump a victory and may oppose the deal, but some of the deal’s stronger rules on labor, autos and the environment may appeal to more liberal Democrats, who often opposed free trade deals in the past.

Senate Democratic leader Chuck Schumer said Trump “deserves praise for taking large steps” to improve NAFTA, but said he would judge the deal on U.S. dairy access to Canada and “real enforcement of labor provisions.”

Mexico’s Guajardo on Monday said the new accord could be signed by the three countries’ leaders when they meet at a Group of 20 summit in Buenos Aires in late November.

Reporting by Steve Holland and David Lawder; Additional reporting by Susan Heavey, Lisa Lambert and in Washington, Frank Jack Daniel in Mexico City and David Ljunggren in Ottawa; editing by Paul Simao and Leslie Adler

In Trump win, Canada, U.S. deal saves NAFTA as trilateral pact

OTTAWA/WASHINGTON (Reuters) - The United States and Canada forged a last-gasp deal on Sunday to salvage NAFTA as a trilateral pact with Mexico, rescuing a three-country, $1.2 trillion open-trade zone that had been about to collapse after nearly a quarter century.

In a big victory for his agenda to shake-up an era of global free trade that many associate with the signing of NAFTA in 1994, President Donald Trump coerced Canada and Mexico to accept more restrictive commerce with their main export partner.

Trump’s primary objective in reworking NAFTA was to bring down U.S. trade deficits, a goal he has also pursued with China, by imposing hundreds of billions of dollars in tariffs on imported goods from the Asian giant.

While the new United States-Mexico-Canada Agreement (USMCA) avoids tariffs, it will make it harder for global auto makers to build cars cheaply in Mexico and is aimed at bringing more jobs into the United States.

Since talks began more than a year ago, it was clear Canada and Mexico would have to make concessions in the face of Trump’s threats to tear up NAFTA and relief was palpable in both countries on Sunday that the deal was largely intact and had not fractured supply chains between weaker bilateral agreements.

“It’s a good day for Canada,” Prime Minister Justin Trudeau told reporters after a late-night cabinet meeting to discuss the deal, which triggered a jump in global financial markets.

In a joint statement, Canada and the United States said it would “result in freer markets, fairer trade and robust economic growth in our region”.

SPONSORED

Negotiators worked frantically ahead of a midnight ET (0400 GMT) U.S. imposed deadline to settle differences, with both sides making concessions to seal the deal. The United States and Mexico had already clinched a bilateral agreement in August.

“It’s a great win for the president and a validation for his strategy in the area of international trade,” a senior administration official told reporters.

Trump has approved the deal with Canada, a source familiar with the decision said. U.S. officials intend to sign the agreement with Canada and Mexico at the end of November, after which it would be submitted to the U.S. Congress for approval, a senior U.S. official said.

FILE PHOTO: Dairy cows are seen on a farm in Saint-Valerien-de-Milton, southeast of Montreal, Quebec, Canada, August 30, 2018. REUTERS/Christinne Muschi/File Photo

COST FOR CANADA

The deal will preserve a trade dispute settlement mechanism that Canada fought hard to maintain to protect its lumber industry and other sectors from U.S. anti-dumping tariffs, U.S. and Canadian officials said.

But it came at a cost.

Canada has agreed to provide U.S. dairy farmers access to about 3.5 percent of its approximately $16 billion annual domestic dairy market. Although Canadian sources said its government was prepared to offer compensation, dairy farmers reacted angrily.

“We fail to see how this deal can be good for the 220,000 Canadian families that depend on dairy for their livelihood.” Pierre Lampron, president of Dairy Farmers of Canada, said in a statement.

“This has happened, despite assurances that our government would not sign a bad deal for Canadians.”

The deal also requires a higher proportion of the parts in a car to be made in areas of North America paying at least $16 an hour, a rule aimed at shifting jobs from Mexico.

Canada and Mexico each agreed to a quota of 2.6 million passenger vehicles exported to the United States in the event that Trump imposes 25 percent global autos tariffs on national security grounds.

The quota would allow for significant growth in tariff-free automotive exports from Canada above current production levels of about 2 million units, safeguarding Canadian plants. It is also well above the 1.8 million cars and SUVs Mexico sent north last year.

Slideshow (3 Images)

But the deal failed to resolve U.S. tariffs on Canada’s steel and aluminum exports.

The Trump administration had threatened to proceed with a Mexico-only trade pact as U.S. talks with Canada foundered.

“It’s a good night for Mexico, and for North America,” Mexican Foreign Secretary Luis Videgaray said.

The news delighted financial markets that had fretted for months about the potential economic damage if NAFTA blew up.

U.S. stock index futures rose, with S&P 500 Index e-mini futures up more than 0.5 percent, suggesting the benchmark index would open near a record on Monday.

The Canadian dollar surged to its highest since May against the U.S. dollar, gaining around 0.5 percent. The Mexican peso gained 0.8 percent to its highest against the greenback since early August.[MKTS/GLOB]

“Though markets were already anticipating an agreement, one source of worry will be swept away if a deal is made,” Yukio Ishizuki, senior currency strategist at Daiwa Securities in Tokyo, said.

“That will lead to a rise in trust in the U.S. economy, so it’s easy for risk sentiment to improve.”

Reporting by David Ljunggren in Ottawa and Roberta Rampton in Washington; Additional reporting by David Shepardson and David Lawder in Washington and Diego Oré, Ana Isabel Martinez and Anthony Esposito in Mexico City; ; Editing by Lisa Shumaker, Peter Cooney & Kim Coghill